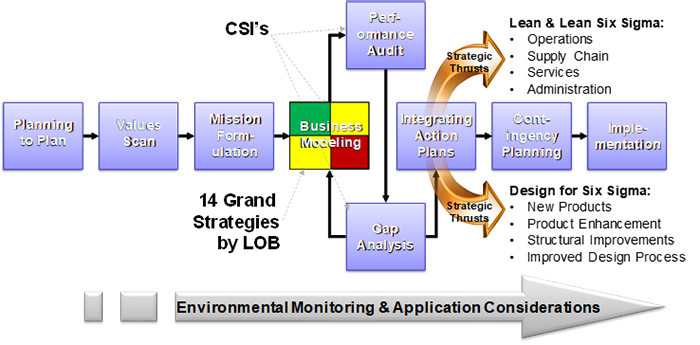

Strategic planning is the process by which determine a path forward for each line of business in the organization. A well-done strategic plan can often be the difference between a successful line of business and a failed business venture. A strategic plan considers many factors which will be described below. We at SigmaPro can help you with this process. The strategic planning model that we use most often involves eleven discrete activities as shown in the diagram below.

Figure 1: General Strategic Planning Model

Adapted from “Applied Strategic Planning,” Leonard Goodstein et al, Jossey-Bass/Wiley, 1992.

The Planning to Plan step involves getting commitment from the executive team, identifying the members of the planning team, preparing the planning team for the strategic planning activity, educating the organization about the process, determining and informing stakeholders, and contracting for a successful strategic plan.

The Values Scan step is an examination of the values of the members of the planning team, the current values of the organization, the organization’s philosophy of operations, the assumptions that the organization ordinarily uses in its operations, the organization’s preferred culture, and the values of the stakeholders in the organization’s future.

Mission Formulation involves developing a clear statement of what business the organization is in (or plans to be in). The planning team must answer four primary questions: What function(s) does the organization perform? For whom does the organization perform this function? How does the organization go about filling this function? Why does this organization exist?

Business Modeling is the process by which the organization specifically defines success in terms of the business(es) it wants to be in, how that success will be measured, what will be done to achieve it, what kind of organizational culture is necessary to achieve this success. As part of strategic business modeling, we must address:

- Identification of the major lines of business (LOB’s) or strategic profile that the organization will develop to fulfill its mission.

- Establishing the critical success indicators (CSI’s) that will enable the organization to track its progress in each LOB that it intends to pursue.

- Identification of the strategic thrusts by which the organization will achieve its vision of the ideal future state.

- Determination of the culture necessary to support those LOB’s, CSI’s, and strategic thrusts.

CSI’s are typically a mix of hard financial figures such as revenue, margins, ROI, etc. CSI’s may also include “soft” measures of success such as employee morale or customer satisfaction. Other metrics may also be included as long as they are clear and measurable such as number of new product launches or number of new markets established.

Table 1. Representative CSI’s

|

Critical Success Indicators (CSI’s)

|

Targets

|

|

Net Profit After Tax (NOPAT)

|

14%

|

|

Liquidity

|

No exceptions on payables;

$700,000 line of credit;

minimum of $15,000 per $1 million in sales

|

|

Compensation-to-Revenue-Ratio

|

2017 rate + 8%

|

|

Size/Growth

|

8% < Growth < 18%

|

|

NPD Reserve

|

$4,000,000

|

|

Employee Satisfaction

|

Overall score > 2019 score

|

|

Customer Loyalty

|

Overall score > 75%

|

|

Inventory Turnover

|

Rate > 3.0

|

|

Marketing-Revenue Ratio

|

Budget on basis of 2019-20

|

As the organization envisions it future, it must identify the specific means of measuring its progress toward that future, setting the critical success indicators for each LOB and for the entire organization. If the vision is the soft side of strategic business model, then CSI’s are the hard side. CSI’s are the gauges to calibrate the progress toward achieving the organization’s mission. Dozens of measures can be selected to track progress toward goals. Measures selected should be relevant to the organizations mission, to the business the organization will engage in, and to those who are responsible for achieving the defined goals. When indicators are selected, they should then be listed in the order of their importance. They will also be used to describe the desired targeted levels of success at the year of strategic planning cycle (3-5 years in the future). The CSI’s will factor heavily into the implementation of the strategic plan through policy deployment. Policy Deployment is the collective process of cascade goals throughout the organization to create alignment around the strategic plan. We create corporate goals based on strategic plan, link them to business unit (BU) goals, link the BU goals to organizational goals, link the organizational goals to functional goals, and finally link the functional goals to goals for departments and individuals. Strategic thrusts are larger-scale organizational initiatives which will typically impact LOB’s and the associated CSI’s. Examples of strategic thrusts include the development of a Lean Six Sigma system, the creation of a fully functioning HR department, implementation of an ERP system such as SAP, or the installation of a point-of-sale system.

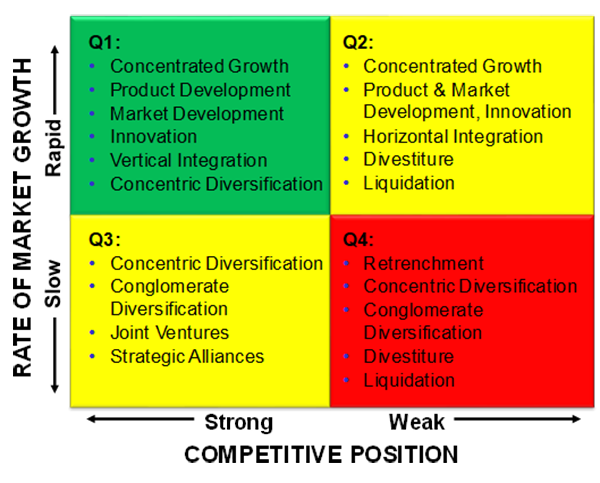

A grand strategy is a comprehensive yet general approach that guides the actions of an individual line of business. Pearce and Robinson (1991) identify fourteen grand strategies.

- Concentrated Growth: focus on a single technology, product, and market.

- Market Development: adding new customers in related markets through customization and channel development.

- Product Development: redesigning or creating new but related products that can be sold in existing markets through existing channels.

- Innovation: creating products that are new or superior such that existing products become obsolete.

- Horizontal Integration: acquiring or merging with a similar organization to reduce competition.

- Vertical Integration: creating an internal supply network or developing an internal distribution system. There are three types of vertical integration: backward (upstream), forward (downstream), and balanced (both directions).

- Concentric Diversification: acquiring or merging with an organization whose technology, products, or markets are complementary.

- Conglomerate Diversification: acquiring or merging with an organization solely for the purpose of increasing profitability, which may or may not be synergistic.

- Joint Venture: teaming up with another organization to develop a new product or market involving strategic advantages for both partners.

- Strategic Alliances: similar to a joint venture, but equity positions are not exchanged.

- Retrenchment: reversing the negative trends in profits through cost-cutting or asset reduction (often referred to as a turnaround).

- Divestiture: selling off or closing down a some or all of the organization.

- Liquidation: selling off an organization in whole or in parts based on the asset value and closing it down.

- Bankruptcy: a liquidation (nonviable organization) or reorganization (viable organization) event.

Strategy development involves the identification of the mix of products and/or services that the organization will offer. The planning team must develop and agree upon the gross revenue, the rate of market growth, required marketing resources, profit potential, investment required, competitive position, etc. for each potential or existing LOB. Strategy development allows the business to change its product/service mix and to drop unprofitable LOB’s. For each LOB the question is: “What mix of grand strategies will allow this line of business to become viable?” Once an organization locates a line of business in one of the four quadrants of the Grand Strategies Matrix based on rate of market growth and competitive position, the preferred overall grand strategies become apparent—or at least a way to begin initiating in-depth discussion. It is critical that the business transformation methodology be well-aligned with the grand strategies for each line of business. SigmaPro’s specialty is to help clients build a custom transformation methodology for each line of business that complements the overall strategy.

Figure 2: Grand Strategy Matrix

At the end of the business modeling phase, the planning team should have developed a strategic plan or business model that consists of the following:

- A strategic profile, including innovation, risk orientation, proactive forecasting, and an approach to beat the competition.

- A set of statements and a graphic representation to identify both the retained and proposed lines of business – the product and service portfolio.

- A clear, prioritized list of CSI’s with defined target dates.

- A list of the strategic thrusts necessary for the organization to achieve its mission together with CSI’s and target dates for initiating these thrusts.

- Specification of the necessary culture that the organization must institutionalize if each of the four prior targets are to be reached.

Before any detailed plan for an organization’s journey into the future can be implemented, the organization must accurately determine its present state using a process called the “Performance Audit.” In this step SWOT (strengths, weaknesses, opportunities, threats) analysis is often used to develop a thorough understanding of the organization’s ability to achieve the desired future state. SWOT should include an external analysis of competitors, suppliers, markets, customer, labor, economic factors, and political trends. The performance audit considers recent performance in terms of basic indicators such as cash flow, growth, staffing patterns, quality, technology, operations, service, profit, ROI, productivity, scrap rate, employee turnover, inventory turnover, facilities, management capability, etc. This step involves creating a clear understanding of the organization’s current performance based on detached objectivity and hard data. The audit is a focused effort that involves the simultaneous study of organizational internal strengths and weaknesses and of the external opportunities and threats that may positively or negatively affect the organization and its efforts to achieve a desired future. The performance audit is intended to provide exact coordinates of the organization's location on important, relevant dimensions, including its internal strengths and weaknesses and its external opportunities and threats–the traditional SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis.

In the Gap Analysis step, we compare the data found in the performance audit with the criteria for successful execution of the strategic plan. For each gap that cannot be closed by a readily apparent strategy, the planning team must return to the business modeling phase and rework the model until the gap is closed. When significant gaps are encountered, several iterations of this process may be required. The gap analysis is necessary to identify gaps between the current performance of the organization and the desired performance required for the successful realization of its strategic business model. Because it is a reality test, the Gap Analysis step is sometimes the “moment of truth,” which can upset and dishearten the most hard-boiled members of a planning team. The Gap Analysis is an active process of examining how large a leap must be taken from the current state to the desired state—an estimate of how big the “gap” is. The “analysis” provides the answer to the question of whether the skills and resources at hand are sufficient to close the gap and achieve the desired future. If the gap is too big or seems too large to close, then either the desired future must be redefined, or creative solutions for closing the gap must be developed. Gap analysis addresses the following questions:

- How does our desired strategic profile compare with our current one?

- How do our planned LOB’s fit with our existing ones and with our resources, both current and planned to bring them on line?

- Where do we stand on our current CSI’s and what does that tell us about our capacity to meet our new ones?

- What are our current strategies and what do they tell us about our capacity to execute our new ones?

- How different is our existing culture from the required one?

There are four basic approaches to closing gaps between the organization’s current and desired state:

- Lengthen the time frame for accomplishing the objective. This approach is used when the current resource allocation is appropriate but more time is needed to achieve the goal than initially planned.

- Reduce the size or scope of the objective. This approach is viable if the vision is appropriate but lesser or somewhat modified objectives are more achievable and less risky.

- Reallocate resources to achieve goals. This approach is appropriate if these goals can be achieved only by focusing existing resources that have been spread too thin.

- Obtain new resources. This approach is appropriate when new talent, products, markets, or capital are necessary to achieve the desired goals.

There are many ways to close the gap between the organization’s current state and its desired future. These options, generally, fall into either a growth or retrenchment strategy. Means to address growth-oriented gaps include internal expansion, new business startups, acquisitions, mergers, or strategic alliances. Retrenchment-oriented gaps are generally addressed via means such as downsizing, divestiture, or liquidation.

In the Integrating Action Plans, otherwise known as Policy Deployment step, two important issues need to be addressed. First, the grand strategies or master business plans must be developed for each of the LOB’s. Then, the various units of the organization – functional and business – need to develop detailed operational plans based on the overall business plan. These unit plans must reflect the grand strategy and must include budgets and timetables. Strategic thrusts are typically defined at a much more detailed level in this step. These thrusts may be short-term, focused activities or long-term, far-reaching activities, ranging from improvement of an inventory management system to the development of complex organizational structures. However, they must align with the desired corporate objectives and culture. The size, detail and complexity of such operational plans and strategic thrusts will depend on the nature of each LOB. The operational plan for each LOB should contain a clear description of the product or service to be offered, the intended target market, and the resources necessary to develop, produce, and deliver this new product or service. These resources will ordinarily include the facilities and machinery necessary to produce the new product, the people -- engineering, production, sales, marketing, management, and others — and the capital requirements. A detailed and realistic marketing plan, timetable for the entire process, and financial analysis, including revenue projections and fixed and variable costs is included. The assignment of overhead allocation should be left for the integration phase and not attempted at this juncture.

The Contingency Planning step involves identifying the most important internal and external threats to and opportunities for the organization, especially those involving other than the most likely scenarios. We also develop trigger points to know when to initiate action plans for each contingency and agree on which action plans will be taken for the respective trigger points. We identify a number of key indicators that will be used trigger an awareness of the need to re-examine the business strategy in place at the time of the trigger. If a trigger point is reached, we may choose to continue monitoring the situation or to take action. In contingency planning, there are five key concepts that are useful:

- Contingency Planning Matrix: This tool helps an organization to ensure that adequate attention is paid to vulnerabilities and opportunities from both the internal and external perspectives during the contingency planning phase of the planning process.

- Organizational Status Taxonomy: This analysis allows an organization to develop a single indicator that is most descriptive of the fiscal viability of the organization.

- Macroeconomic Indices: These are metrics that are available from the environment and that are determined to be most significant to the organization or, where applicable, to the composite lines of business.

- Expanded Business Indices: These are metrics to be monitored by the various LOB’s, SBU’s, departments, divisions and so on.

- Composite Budget-Variation Indicators: These metrics provide the cumulative accuracy of the current year's budget, with a weighted variance indicator that can be keyed to both opportunity and vulnerability triggers for plans identified in contingency planning.

Internal threats might include the death or severe disability of an irreplaceable staff member or the destruction of a key facility. Aside from universal external threats such as war or economic collapse, each type of business or organization is subject to a specific set of contingencies that must be planned for. Contingency planning involves the development of specific actions when lower-probability events that would have important consequences for the organization. Two key components in contingency planning are probability and impact. They involve potentially high-impact events that do not have the highest probability of occurring. A tool from process improvement, Failure Modes and Effects Analysis (FMEA), can be employed here which often provides outstanding clarity around key issues.

Implementation of the strategic plan involves the concurrent initiation of several tactical and operational plans designed at the unit and functional levels plus the monitoring of these plans at the organizational level. All stakeholders need to be informed when the strategic plan is initiated, and they need to agree to support the strategic plan. The necessary changes in the management control system, the information system, and the organization culture needed to execute the strategic plan must also be initiated. Implementation deliverables include:

- Creation of an action plan for communicating and reinforcing the strategic plan with all stakeholders.

- Identification of modification needed for business control systems to support the strategic plan.

- Identification of modifications needed for motivation and reward systems to support the strategic plan.

- Identification of modifications needed for the information systems to support the strategic plan.

- Identification of ongoing training and tools needed to provide employees with the ability to execute tactical plans.

Environmental Monitoring is an ongoing process in which the organization maintains awareness of: Demographics as well as technological, political and economic factors, the industry environment, the competitive environment, and the organization’s internal environment.

Application Considerations is the process of identifying and keeping informed all stakeholders as to the process by which the strategic plan is being developed and to be implemented.